In today’s rapidly evolving banking landscape, financial institutions are increasingly turning to advanced technologies to streamline operations, enhance customer experiences, and stay competitive. One of the most powerful solutions for achieving these goals is Dynamics 365 Customer Engagement (CE), when integrated with Artificial Intelligence (AI). By combining these technologies, banks can optimize their processes and unlock a new level of innovation. While the capabilities of Dynamics 365 CE are already impressive, there are several key areas where AI can further drive transformation and elevate the banking experience.

Here’s a detailed look at the core areas where Dynamics 365 CE, powered by AI, can create transformative value in banking:

1. Personalization and Customer-Centric Services

In the modern banking world, personalization is key to gaining and retaining customers. Dynamics 365 CE, combined with AI, allows banks to offer deeply personalized experiences by analyzing customer data, including financial habits, preferences, and transaction history.

- Lifestyle-Based Insights: AI models can analyze customers' spending and saving behaviors to recommend relevant financial products, such as loans, credit cards, or investment opportunities, based on individual lifestyles.

- Dynamic Pricing: AI can help adjust loan rates, credit card offers, and other products in real-time, ensuring that customers receive competitive and tailored pricing based on their financial profile and risk.

2. Fraud Prevention and Security

Security is one of the most critical aspects of banking, and AI can greatly enhance fraud detection and prevention.

- Behavioral Biometrics: By analyzing patterns in how customers interact with their devices—such as typing speed, mouse movements, and device usage—AI can identify unusual behaviors that may indicate fraud.

- AI-Powered Threat Intelligence: Proactively detect and mitigate emerging threats through AI-driven systems that constantly monitor for suspicious activities, allowing banks to respond faster and prevent potential breaches.

3. Predictive Analytics for Proactive Services

AI-powered predictive analytics in Dynamics 365 CE allows banks to predict customer needs and optimize their services.

- Customer Churn Prediction: By analyzing historical data, AI can predict which customers are at risk of leaving and enable banks to take proactive measures, such as offering personalized retention strategies or loyalty rewards.

- Operational Optimization: AI can forecast demand for banking services (e.g., loan applications, customer support requests) and help banks allocate resources more effectively, ensuring a smooth operation.

4. Financial Inclusion and Microfinance Solutions

Banking has traditionally been limited by geographic and socio-economic factors, but AI can expand access to financial services.

- AI Chatbots for Financial Education: AI-driven chatbots can provide customers with instant information and guidance on a variety of financial products, improving financial literacy and empowering underserved populations.

- Microfinance Support: AI can help banks design and manage microfinance programs tailored to the needs of low-income individuals, offering small loans or savings options to promote financial inclusion.

5. Voice of the Customer (VoC) Analytics

Understanding customer sentiment is crucial for improving services and maintaining positive relationships.

- AI-Driven Sentiment Analysis: By analyzing feedback from surveys, social media, and customer service interactions, AI can identify trends, emotions, and potential areas for improvement. This enables banks to take corrective actions promptly and improve customer satisfaction.

- Proactive Issue Resolution: AI can detect emerging customer concerns before they escalate, allowing banks to address issues proactively and enhance the overall customer experience.

6. Driving Product Innovation

AI helps banks stay ahead of the curve by identifying market trends and consumer demands.

- AI-Powered Product Refinement: By analyzing customer feedback and usage patterns, AI can help banks refine their existing products and develop new ones that better meet customer needs.

- Cross-Sell and Up-Sell Opportunities: AI can identify patterns in customer behavior that suggest potential interest in additional products or services, allowing banks to offer relevant products at the right time.

7. Gamified Loyalty Solutions

In a competitive market, customer loyalty is essential. Banks can enhance engagement and loyalty through gamification.

- AI-Driven Loyalty Programs: By integrating AI with gamified loyalty solutions, banks can create interactive, rewarding experiences for customers. Offering points, badges, or rewards for completing transactions, referring friends, or achieving savings goals can encourage customer retention and engagement.

- Personalized Rewards: AI ensures that loyalty rewards are tailored to individual preferences, increasing the relevance and value of incentives.

8. Sustainability and ESG Tracking

As global awareness of environmental, social, and governance (ESG) issues grows, banks are under increasing pressure to integrate sustainable practices.

- AI for ESG Reporting: AI can track and analyze data related to a bank's sustainability efforts, such as carbon footprint, renewable energy investments, and socially responsible lending. This enables banks to report transparently on their ESG performance and align with sustainability goals.

- Carbon Footprint Minimization: AI can help banks identify areas where operations can be made more energy-efficient, contributing to cost savings while reducing environmental impact.

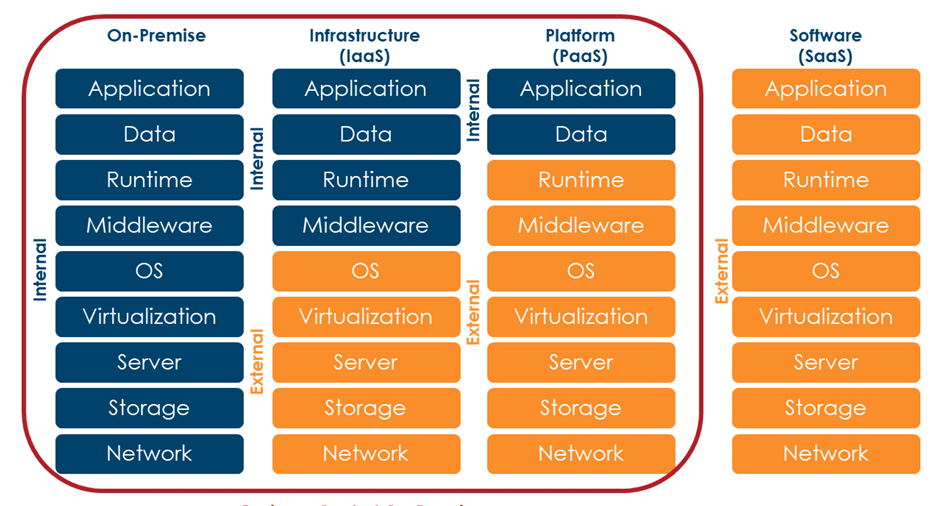

9. Seamless Integration with Ecosystem Partners

In today’s interconnected world, banks need to work closely with other players in the financial ecosystem.

- Third-Party Integrations: Dynamics 365 CE can be easily integrated with other financial institutions, FinTechs, e-commerce platforms, and government services through APIs, creating a unified ecosystem.

- Open Banking: By supporting open banking initiatives, banks can securely share customer data with third-party providers to offer new services, such as budgeting tools or investment advice, fostering greater innovation.

10. Advanced Reporting and Real-Time Insights

Data-driven decision-making is essential for effective management, and AI can enhance reporting and analytics.

- Real-Time Dashboards: Integrating Power BI with Dynamics 365 CE allows banks to create dynamic dashboards that provide real-time insights into key performance metrics, customer behavior, and operational efficiency.

- Regulatory Reporting: AI can automate regulatory reporting, ensuring banks stay compliant with local regulations while reducing administrative overhead.

Conclusion: A Future-Ready Banking Ecosystem

The combination of Dynamics 365 CE and AI offers a powerful platform for banks to enhance operational efficiency, deliver personalized customer experiences, and drive innovation. By focusing on areas such as personalization, fraud prevention, predictive analytics, product innovation, and sustainability, banks can stay ahead in an increasingly competitive financial landscape.

As AI continues to evolve, the potential for transforming banking operations is immense. With the right tools and strategies, banks can optimize their services, improve customer satisfaction, and contribute to a more inclusive, sustainable financial ecosystem.

What other areas do you think banks should explore for optimization and growth? Feel free to share your thoughts!

Related Articles

Leave a comment

Subscribe to the best creative feed.

Don't worry, we don't spam

1 Comments

Eiman 3 months ego

Nice article, good insight

Reply